- The U.S. Department of Health and Human Services (HHS) Paid Nearly $14.5 billion in fraudulent claims in 2014.

- A Texas physician was arrested for defrauding Medicare of more than $375 million, but the collection of smaller crimes cause more damage.

- No Federal agency pays more in false claims than the HHS.

- Under the Affordable Care Act, more than $600 million have been spent to prevent fraud and to recover fraudulent payments.

In February of 2012 a Texas physician, Jacques Roy, MD, was arrested for defrauding Medicare of more than $375 million. While this is an enormous amount of money, and it certainly made the papers, it was small piece of the overall Medicare fraud.

Prosecutors say Dr. Roy recruited thousands of patients and billed the Federal government for medical services that the patients didn't need or that were never performed.

The indictment alleges that Dr. Roy took advantage of a Medicare rule that a doctor must certify that services for patients are medically necessary. He sold his certification to home healthcare companies, prosecutors say, and in turn, the companies filed fraudulent charges with Medicare and Medicaid and gave part of the payments to Dr. Roy.As a result of the investigation, 78 companies that worked with Dr. Roy's business had their eligibility to receive Medicare funds suspended, and 6people were charged as his co-conspirators.

From 2006 to 2011, his company, Medistat Group and Associates, worked with more than 500 Texas home health-care companies to certify over 11,000 patients – more than any other medical practice in the country, according to the indictment. Together, they charged Medicare more than $350 million and Medicaid more than $24 million. This was the single largest Medicare fraud in U.S. history, according to The Medicare Fraud Center.

Fraud Persists

But Texas is not the epicenter of the Medicare fraud epidemic, nor are the largest cases the most damaging.

The cost of fraud and systematic overcharging are estimated at roughly $60 billion, or 10% of Medicare’s costs every year, according to an article in The New York Times.

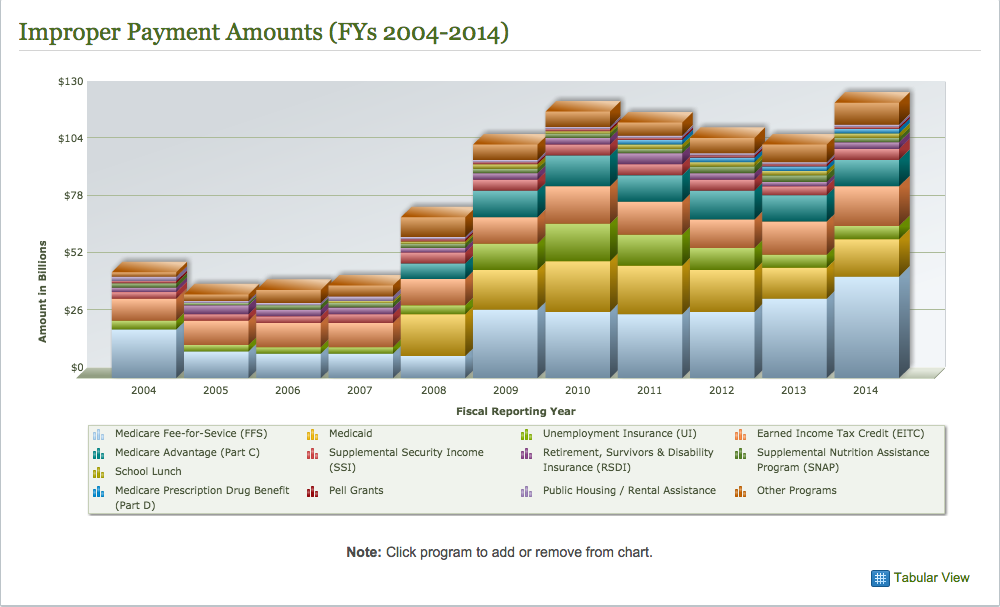

On top of the as much as $60 billion lost to the Federal government through fraud in 2014 (See Figure 1; 2013 figures), the Obama Administration has so far spent more than $600 million to staunch the flow of money. Despite this $600 million spent, the administration recovered only about $4.3 billion last year.

The Centers for Medicare and Medicaid Services, which is responsible for overseeing the effort, manually reviews just 3 million of the estimated 1.2 billion claims it receives each year.

Florida

Is one extremely notable case from Texas a sign that there an epidemic of Medicare fraud afoot? If one were to rely on a case study such as Florida, it would be easy to conclude that there is something like an epidemic ongoing.

An article on Forbes.com lists a number of important cases in Florida. The accusations and the convictions reflect widespread cases of overbilling, billing for medically unnecessary care, billing for care that was never administered, care provided by employees who did not exist, as well as kickbacks, self-referrals, healthcare fraud, falsifying patient files, money laundering, and structuring to avoid reporting requirements, among others. (See Figure 2.)

Smaller Cases are More Damaging

For a number of reasons, the vast collection of Medicare fraud cases are more damaging to the program, to the nation, and to the American taxpayer than are the handful of giant cases. Indeed, a very enterprising criminal physician in Texas put together a illegal network that funneled perhaps as much as $85 million into his pockets and those of his co-conspirators.

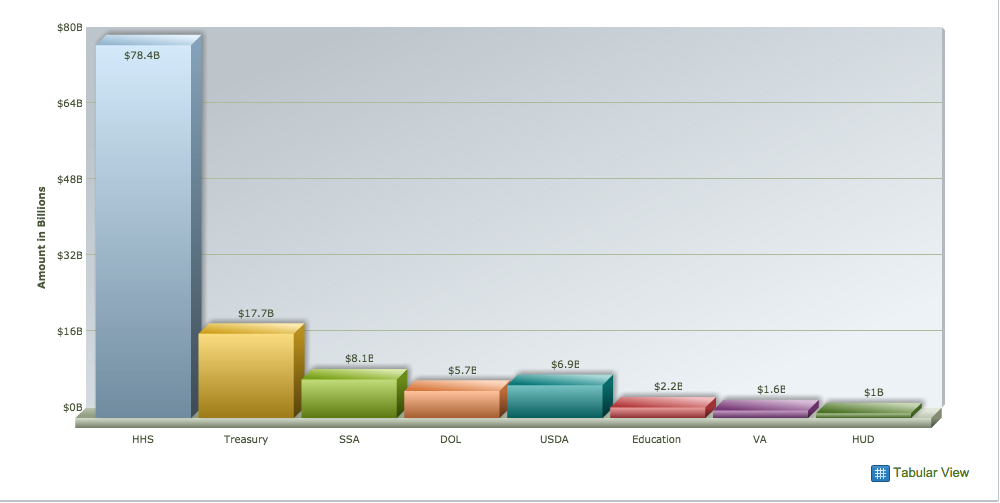

But the tens of thousands of lesser cases are what add up to the nearly $14.5 billion in fraud committed against the Department of Health and Human Services every year. In fact, the department of Health and Human Services loses more to improper payments than many other departments combined. (See Figure 3.)

Figure 3. Improper payments by agency for fiscal year 2014.

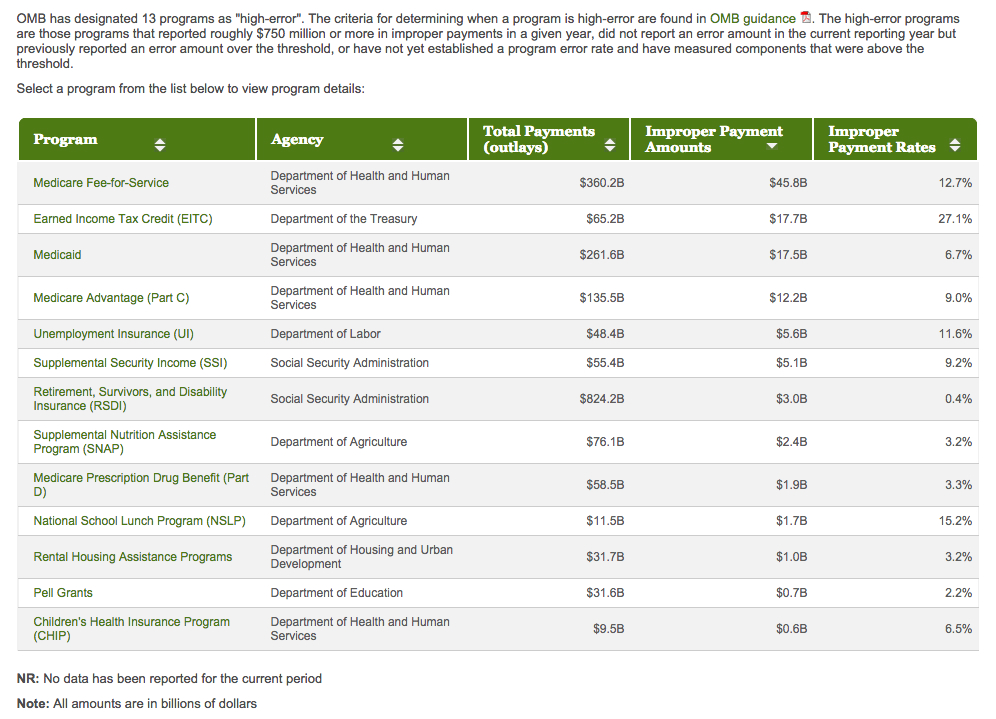

The HHS is also considered by the Federal government to be a high error program. While the HHS error rate is lower than that of a small department within the Department of the Treasury (See Figure 4.), the actual dollar amount is 5 x that same subdepartment.

According to Health Beat, by Maggie Mahar, “Even more confounding, “fraud” can be perpetrated on vastly different scales: by multi-state organized crimes rings that improperly bill Medicare for $40 million dollars of home health care, by a single physician who brings in an extra $20,000 a year by regularly “up-coding” office procedures (i.e. like the dermatologist my daughter used to see who squeezed a pimple at each visit and billed our insurance $250 for “acne surgery”), and by giant health care companies like HCA who systematically defrauded Medicare of hundreds of millions of dollars.” (You can read more of Ms. Mahar’s articles here.) This one was posted on August 25, 2011 by Naomi Freundlich.

According to HealthReform.gov, more than $350 million have been allocated within the Affordable Care Act over the next 10 years to prevent fraud and to help the government recoup lost funds.

Figure 4. High billing error departments within the Federal government.

According to Fraud magazine, 10 common healthcare provider fraud schemes include the following:

- Billing for services not rendered.

- Billing for a non-covered service as a covered service.

- Misrepresenting dates of service.

- Misrepresenting locations of service.

- Misrepresenting provider of service.

- Waiving of deductibles and/or co-payments.

- Incorrect reporting of diagnoses or procedures (includes un-bundling).

- Over-utilization of services.

- Corruption (kickbacks and bribery).

- False or unnecessary issuance of prescription drugs.

Other common types of Medicare fraud include:

- Hospice care centers over billing for patient stays and care.

- Rehabilitation centers systematically inflating rehab bills.

- Durable medical equipment fraud: kickbacks schemes in medical sales of items such as bedding and wheelchairs.

- Nursing home over billing of staff time and patient care.

- Assisted living center fraud.

- Medical coding: alteration of medical codes for different procedures and diagnosis.

- Ambulance service fraud: billing for rides not authorized by Medicare.

If You See Something, Say Something

Help stop government waste and abuse, and get rewarded for your efforts. Our attorneys have significant experience representing healthcare industry whisteblowers. Complete the secure form on this page or call (800) 581-1790 for a free, no-obligation consultation with an attorney.